Motives of Liquidity Preference Theory

Here we Understand the Motives of Liquidity Preference Theory in detailed.

Do you have similar website/ Product?

Show in this page just for only

$2 (for a month)

0/60

0/180

Motives of Liquidity Preference Theory

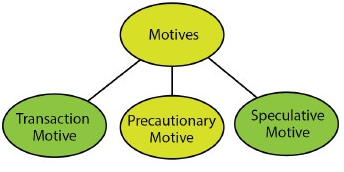

This theory has been explained by Professor Keynes in his theory of Interest. According to him, the desire for liquidity exists because of three motives. They are as follows:

- The Transactions motive

- The precautionary motive and

- The speculative motive.

- The Transactions Motive: This relates to the demand for money or the need for cash to meet the current transactions of the individual and business firm. Individuals hold cash in order to bridge the interval between the receipt of income and expenditure. It is known as 'income motive'. There is a time lag between the receipt of income and expenditure. According to him, many people receive their income after a week or a month while they have to make payments almost day by day. Hence a certain amount of 'ready money' (liquid cash) is kept on hand to make current payments. This amount will depend upon the size of the individual income, the interval at which the income is received and the methods of payment prevalent in that locality. Same way, businessmen and entrepreneurs also keep a proportion of their resources in ready cash in order to pay for raw materials and transport, to pay wages, salaries and to meet other current expenses. Keynes calls this as 'business motive' for keeping money, and this will largely depend on the turnover of the business firm. According to him, the larger the turn-over, greater will be the amount of money needed to meet current expenses.

- Precautionary Motive: This refers to the desire of the people to hold cash balances to meet unforeseen expenses. According to Keynes, here People like to keep a certain amount of money in ready cash to provide for the danger of unemployment, sickness, accidents and other uncertainties. The amount of money held under this motive depends on the temperament of the individual and the conditions in which he lives.

- Speculative Motive: The speculative motive refers to the desire of the people to hold money in liquid cash to take advantages of the future changes in the rate of interest.

When people expect the rate of interest to rise in future, they would hold a greater amount of money in cash with a view to lend the same in future at higher rates and thus make a gain thereby.

According to Keynes, The demand for money for speculative motive however, is a function of the rate of interest. If the current rate of interest is high, less money will be demanded or held in liquid cash under this motive and if the rate of interest is low, more money will be demanded or held in liquid cash for speculative purposes. Means, there is an inverse relationship between money held for speculative motive and the prevailing rate of interest.

CONTINUE READING

Motives of Liquidity Preference theory

the Transactions Motive

the Precautionary Motive

the Speculative Motive

Liquidity preference theory of Interest- Motives of Liquidity Preference theory.

Kinnari

Tech writer at NewsandStory