File Income Tax on Bitcoin Profits in the USA

2017 has been a great year for Bitcoin, and now it’s time to know about the taxes on Bitcoin Profit. Most people who held on to Bitcoin over the past year made money off of it, and as Americans prepare for income tax season, the IRS (Internal Revenue Service) wants its cut of the profits.

Do you have similar website/ Product?

Show in this page just for only

$2 (for a month)

0/60

0/180

File Income Tax on Bitcoin Profits in the USA

Bitcoin has a global acceptance and is less volatile than cash / local currency. Due to this feature, it becomes easier to conduct transactions across boundaries and online. Landmark feature of a Bitcoin is that it can curb the chances of fraud and identity thefts, and hence is considered a safe mode of holding money. Bitcoins allow buying of goods and services online, as well as transferring money.

2017 has been a great year for Bitcoin, and now it?s time to know about the taxes on Bitcoin Profit. Most people who held on to Bitcoin over the past year made money off of it, and as Americans prepare for income tax season, the IRS (Internal Revenue Service) wants its cut of the profits.

There are actually 3 ways in which you can earn Bitcoin & the taxation differs from one to another. You can get Bitcoin by:

? Mining them

? Purchasing them from Bitcoin exchange for real money

? Receiving them in return for sale of goods or services

Now, moving on to the part about taxes, here are the major steps that you need to understand in order to report the taxes. But if you are unsure about this you can always consult your Tax Lawyer.

Documenting Everything- We?re talking about income tax, so your goal is to figure out your income from Bitcoin in 2017. For the purposes of the IRS, that means Bitcoin assets that were converted into non-Bitcoin assets like cash or goods and services. Your Bitcoin holdings aren?t taxable (at least not yet), but any time you sold Bitcoin or used it to buy something, you were accruing taxable income.

The records of your transactions are already either on the blockchain or with your wallet provider. First, you?ll want to download all transaction data from the exchanges you use, usually available as CSV (Comma Separated Values) files.

There is also software that can help with Bitcoin taxes, such as Bitcoin.Tax and CoinTracking.Info. Bitcoin.Tax lets you upload CSV files from exchanges, and it?s free for up to 10 transactions. CoinTracking.Info does the same, and it?s free for up to 200 transactions.

Where to Report Bitcoin Income?

Most people will have income from buying Bitcoin and then selling it at a higher price. If that?s true for you, then any income from the sales needs to be reported on Schedule D, an attachment to Form 1040.

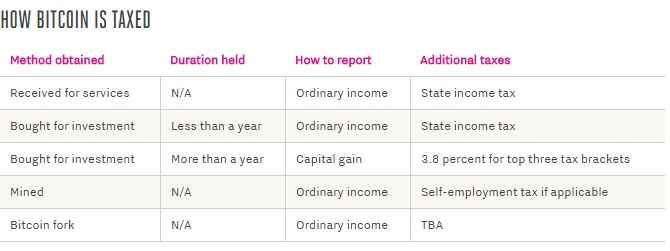

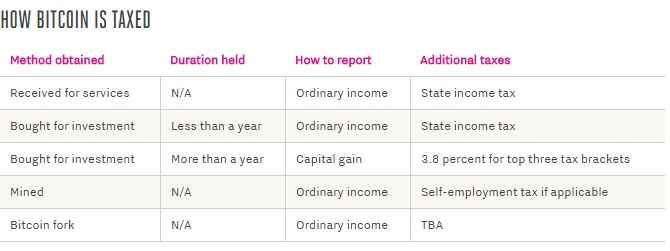

How you report the sales will depend on how long ago you bought your Bitcoin.

? If you?ve held the Bitcoin less than a year before transacting with it, it?s taxed as a short-term capital gain, which is still taxed at the same rate as ordinary income.

? If you?ve held Bitcoin longer than a year before using it, Bitcoin is taxed as a long-term capital gain at lower rates of anywhere from 0 to 20 percent, also depending on what income bracket you fall under.

? If you?re in the top three highest income brackets, you also have to pay a 3.8 percent tax on net investment income.

In every case, the tax rate on your Bitcoin sales depends on your method of acquiring Bitcoin and the length of time you?ve held it. Here?s a chart, because it?s complicated. Just know you?ll be making heavy use of the first few pages of your tax return as well as Schedule D.

How Bitcoin is Taxed?

? Through Mining- If you were mining your own Bitcoin. Any Bitcoin gained through mining is taxed as ordinary income, based on the ?fair market value? of the Bitcoin at the date it was received. Additionally, if the mining counts as a trade or business transaction, and the taxpayer aren?t doing it for an employer but for themselves, they have to pay the self-employment tax, which is 15.3 percent on the first $127,200 of net income and 2.9 percent on any income in excess of $128,400.

? If you were paid for goods or services in Bitcoin, it gets taxed as ordinary income. Depending on your income bracket for 2017, the federal tax rate can be anywhere from 10 percent to 39.6 percent. The Bitcoin will also be subject to state income tax.

? If your Bitcoin account is held abroad where the private keys are owned directly by the exchange, the value of the account has to be reported to the US Treasury using FinCen form 114, and to the IRS with the form 8938. US residents and citizens who own less than $10,000 of assets abroad don?t have to report.

The new Bitcoin cash is also taxable income, although the IRS has not yet addressed this event and provided guidance for Bitcoin Spinoff.

How can you minimize Bitcoin Taxes?

? You can donate cryptocurrency to charities but you must donate directly to the charity, as selling it first would be taxable. While charities like Goodwill may not accept Bitcoin, you can still donate to causes like The Water Project, Wikileaks, and the Internet Archive to name a few.

? You can also hold on to the Bitcoin long-term, disregarding the downturn in Bitcoin prices recently and any desire to cash out early, in order to defer taxation

? Other countries have lower tax rates than the US. Germany, for instance, treats cryptocurrency as a currency, while Denmark doesn?t tax capital gains. So you can sometimes hold your cryptocurrency under your relatives names living in these countries.

What if you don?t pay the Tax?

If the IRS catches on that you didn?t pay the tax, you?ll be dealt with like any other tax evader. You?ll be sent a deficiency notice which you can either pay or contest. Common fees include a ?substantial understatement? penalty and ?negligence or disregard of the rules? penalty, which are an additional 20 percent of the net understatement of tax. If the IRS thinks you knew about the Bitcoin tax rates and laws and faked your tax return anyway, it will charge you an additional 75 percent of the underpayment for fraud.

The IRS has gone after Bitcoin tax evaders before. In 2016, the IRS requested the Coinbase records of all the people who bought Bitcoin from 2013 to 2015. After examining tax returns from those years, the IRS found that only 800 some people reported their Bitcoin gains on the form 8949 each year. (Form 8949 is a summary of Bitcoin gains that basically supplements form 1099, which cryptocurrency taxpayers don?t get from exchanges.) The IRS partnered in 2015 with a company called Chainanalysis to identify owners of digital wallets who haven?t been paying their Bitcoin taxes.

CONTINUE READING

Business

International

News

Sandeep Semwal

Content Writer