HOW TO FILE TAX RETURN IN INDIA?

A BRIEFING ABOUT ITR AS WELL AS THE STEPS TO FILE THE RETURN

Do you have similar website/ Product?

Show in this page just for only

$2 (for a month)

0/60

0/180

HOW TO FILE TAX RETURN IN INDIA?

Income tax in India has a great importance as it provides the revenue to the government department and which that amount a budget is prepared for various activities of the government which are performed solely for the benefit of people at large. The name itself has the meaning a tax is deductible or chargeable on the income earned but subject to the Finance Act issued yearly. It?s a long process as the finance act is first proposed as finance bill and after being approved in both houses of Parliament and after receiving authentication by the President of India it is implemented along with various notification which is issued in official Gazette.

There are many sections of society and not everyone earns a handful amount of income, our government has been liberal to them and has provided slab rate to charge income tax on a different section on the basis of a range of income earned by them. After calculating the total taxable income and then deriving at the Income Tax Payable, one needs to know how to file an Income Tax Return(ITR) We have a bifurcation of ITR according to the type of the taxpayer.

They are as follows:

ITR-1(SAHAJ) For Individual Having Income from Salary and Interest.

ITR-2For Individuals and HUFs Not Having Business / Professional Income.

ITR?3For Individuals and HUFs Being Partners in Firms and Not Carrying Out Business or Profession Under and Proprietorship.

ITR-4For Individuals and HUFs Having Income from Proprietary Business or Profession. ITR-4S (SUGAM) For Individuals and HUFs Having Income from Presumptive Business.

ITR-5For Firms, AOP and BOI. ITR - 6 For Companies Other Than Companies Claiming Exemption U/s 11

ITR-7For Persons Including Companies Required to Furnish Return Under Section 139(4A) / 139(4B) / 139(4C) / 139(4D). (Not Opting For E-Filling).

Acknowledgement (ITR V) Where the Data of Return of ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6. Filled Electronically Without Digital Signature.

Earlier We had an option to provide submission manually or online but now e-filling is compulsory for the taxpayers of a specific category and you may confirm the same through the official website of income tax India. In case you are not eligible to pay tax then you can manually submit the "NIL" return to Income Tax Department.

So, here we would further discuss the e-filling method:

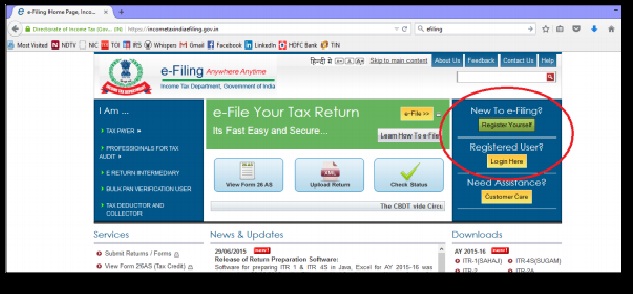

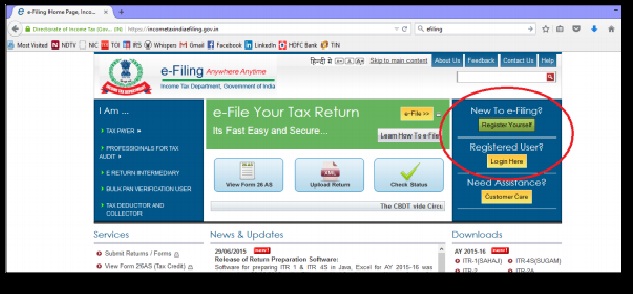

1.Register on the official website of Income Tax Department by providing all of your details, sign up with correct details and please be cautious as it is a very important thing.

2.Kindly recheck the details which are as per the identification cards issued by the government of India such as Aadhaar card, PAN Card, etc.

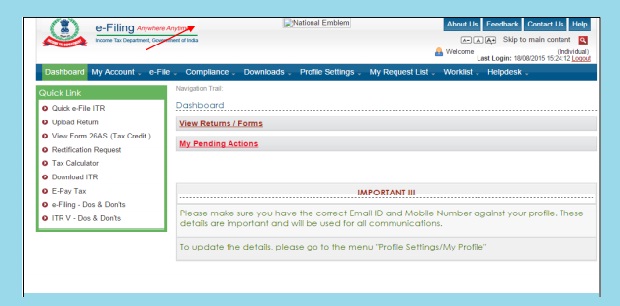

3.Now, login to with your username and password that you just generated by submitting your details. (kindly refer the image attached)

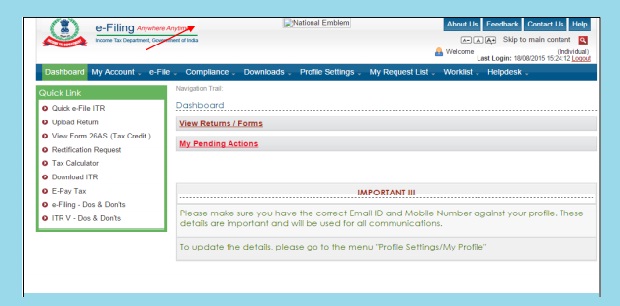

4.Now click on the option "Compliance" and a menu will be dropped down with an option of "View and Submit Compliance", please click on the same and a new window will appear.

5.Kindly, fill the required details asked for and re-submit the form in "XML" format and confirm by clicking on submitting button. Print the ITR-V generate and send it to Income Tax Department, Bangalore.

Link to the official website: https://incometaxindiaefiling.gov.in/home

CONTINUE READING

income tax filling

ANAMIKA KHATRI

CONTENT WRITER