File Income Tax on Bitcoin Profits in India

So, the gains from Bitcoin are taxable in India. Let me guide you through the steps of how to report the Income Tax on Bitcoin profits.

Do you have similar website/ Product?

Show in this page just for only

$2 (for a month)

0/60

0/180

File Income Tax on Bitcoin Profits in India

Bitcoin today has become a phenomenon; there are many gateways that allow Bitcoin trade. However, people still have trust issued finding the right person to trade with. In India the most trusted apps or websites to trade Bitcoins are Zebpay, Unicon and LocalBitcoins.com. Bitcoin is soaring in popularity and user adoption in India.

It has been estimated that India now accounts for over 10 percent of the global Bitcoin trade. In the past 12 months, Bitcoin has witnessed a staggering growth of over 1,200 percent in value and remains a favorite among cryptocurrency enthusiasts.

Income Tax on Bitcoin Gains

Though Bitcoin is yet to be officially recognized in the India, the Reserve Bank of India (RBI) has on three separate occasions put out risk warnings against investing in virtual currencies. RBI has not given license to any company to trade in Bitcoin; but no law makes the Bitcoin trading illegal in India.

Archit Gupta, Founder & CEO ClearTax, says, "Even though Bitcoins are not specifically mentioned in the income tax act, Bitcoins are assets which are usually owned so holder can gain from an increase in its value. In that sense, they acquire the definition of capital gains. This is a wide definition as per the Income Tax Act."

Also, Saurabh Agrawal, CEO and Co-founder, Zebpay, a Bitcoin exchange, agrees, "One needs to pay tax on profits made from investing in Bitcoin. One should declare the income while filing taxes."

So, the gains from Bitcoin are taxable in India. Let me guide you through the steps of how to report the Income Tax on Bitcoin profits.

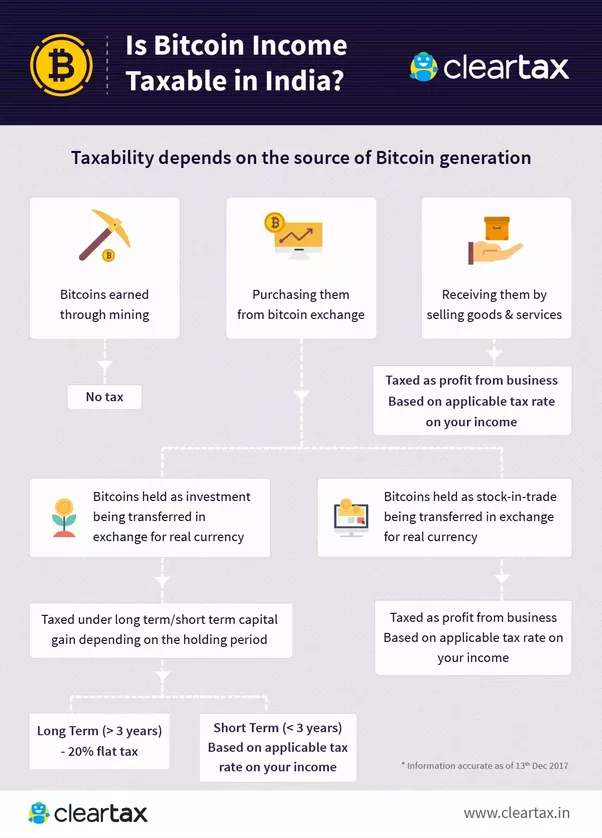

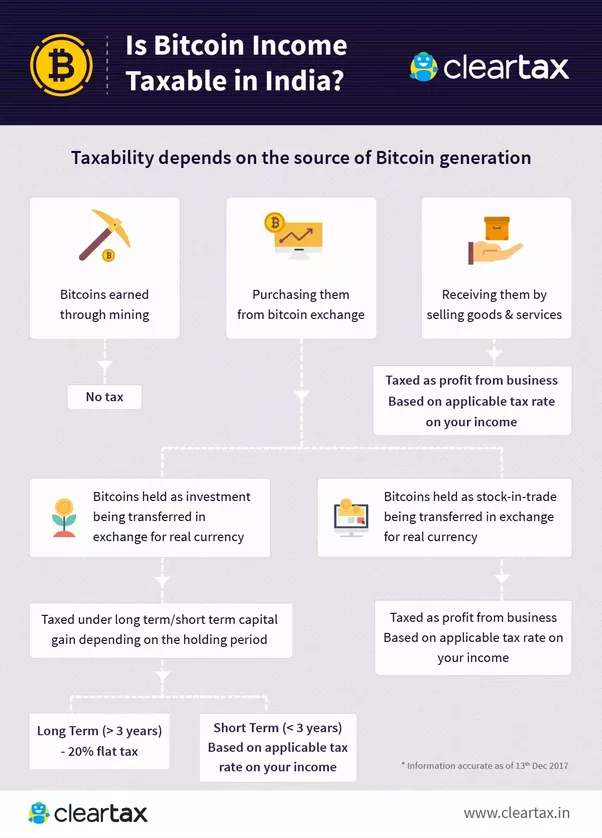

There are actually 3 ways in which you can earn Bitcoin & the taxation differs from one to another. You can get Bitcoin by:

? Mining them

? Purchasing them from Bitcoin exchange for real money

? Receiving them in return for sale of goods or services

The IT Act does not stop you from earning or profiteering from investments in cryptocurrencies and allows you to declare your gains and pay taxes on it.

The Tax on Bitcoins earned through mining - No tax (This may change in the near future). If you fall under this category of Bitcoin users then you are likely to be only selling and never purchasing any Bitcoins. This is somewhat similar to rendering services as a consultant and earning in Bitcoin with the only difference being that you are not a professional.

The Tax if you are a casual investor in Bitcoins- Any profit resulting from sale of your cryptocurrency is taxed as short-term capital gains as per your income tax slab rate. If your income exceeds Rs 10 lakh then there will be a 30 % tax on the profits plus surcharge and cess.. Bitcoins similar to most other assets are usually owned with the expectation that the owner will gain from an increase in its future value.

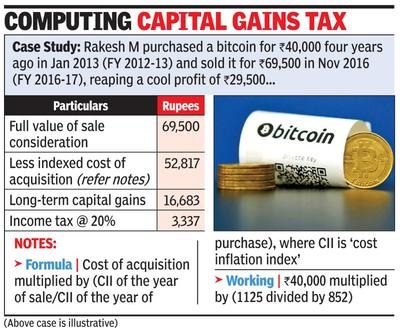

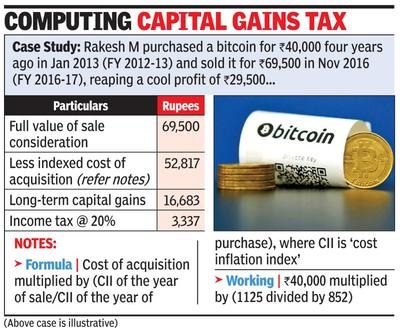

In case of any long-term capital gains, the tax rate applicable is only 20% on your profits. The time period of the asset needs to be considered here while making an assessment and most auditors seem to be preferring to equate the time period of equity (minimum holding period of 2 years) to Bitcoins.

Therefore, Bitcoins purchased from Bitcoin exchange, Bitcoins held as investment being transferred in exchange for real currency are taxed under long term / short term depending on the holding period

Long term (>3 years) - Flat 20% tax

Short term (< 3 years) - Taxed according to your individual tax slab rate ((Applicable on your income))

The Tax if you are a Bitcoin trader with substantial and frequent transactions it could be considered as a business (trading) income. Here you can account for your profit and loss accordingly. CBDT (Central Board of Direct Taxes) in the past has issued a circular to distinguish when equity is held short-term as an investment versus stock-in-trade. Here, an applicable rate of income tax as per your income slab will apply. If your income exceeds 10 lakh rupees then the applicable tax rate is 30% plus surcharge and cess.

The Tax if you are a blogger, freelancer or consultant earning in Bitcoins, you may be wondering how to file your taxes for income from any services rendered to clients in India or abroad. Here, an applicable rate of income tax as per your income slab will apply. If your income exceeds Rs 10 lakh then the applicable tax rate is 30% plus surcharge and cess.

CONTINUE READING

Business

News

International

Sandeep Semwal

Content Writer