Entities in online payment

Here we understand about Entities in online payment in detail as follows-

Do you have similar website/ Product?

Show in this page just for only

$2 (for a month)

0/60

0/180

Entities in online payment

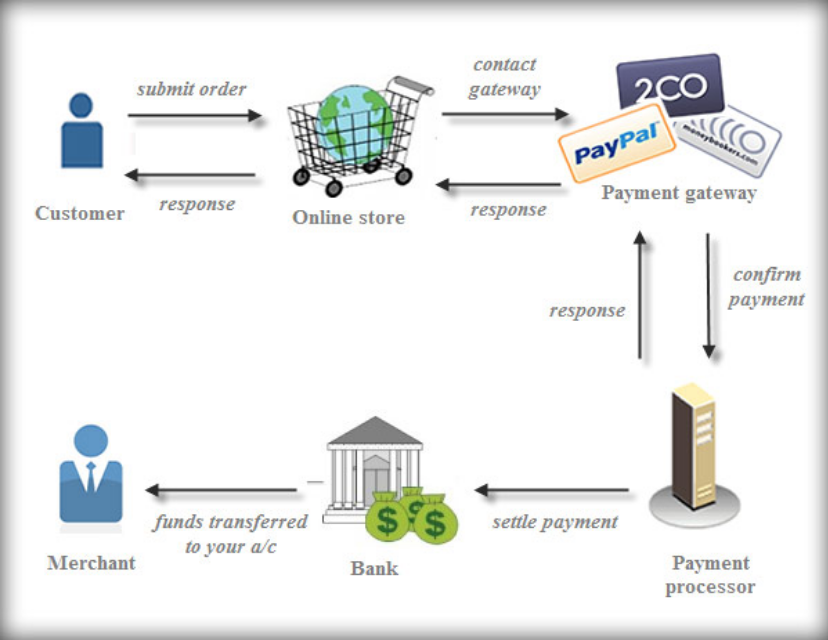

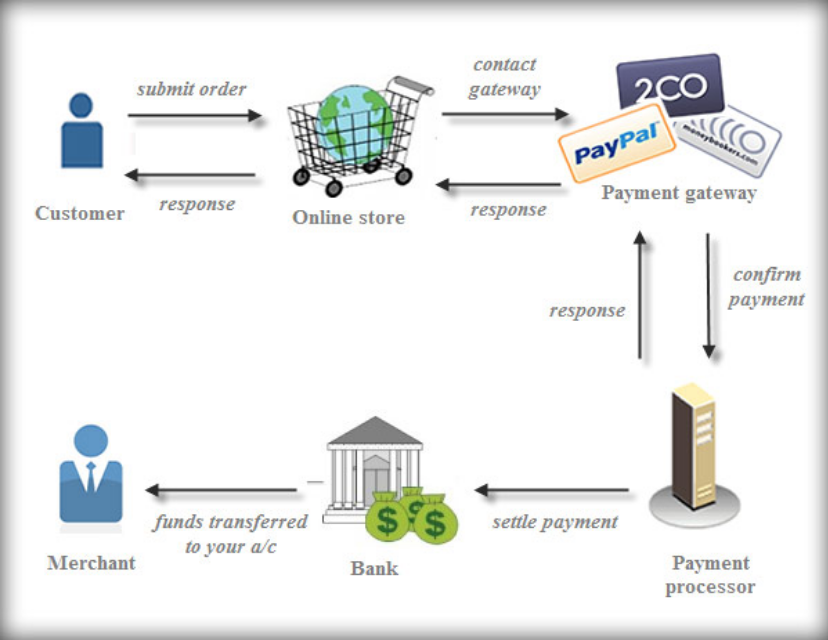

- Gateways and processors are the important entities in online payment.

- Payment gateways are the services provided by the third party like Paypal (ABC payments.com) which connection networks of all the parties involved and enables to perform authorization and payment in secured manner.

- Processors are the data centers which perform the credit card transactions and settle funds to the merchant. They all connected to e-commerce website of the merchant through the payment gateway.

- The online payment through the credit card on Internet is divided into two categories that is - (a) Authorization and (b) Settlement.

(a) Authorization process:

- we know that as we have to go to the shop and select the item if we want to buy it. Same way a customer uses web browser to connect to merchants server and to buy product or service. Means customer uses web browser (for e.g. write www.Indiamart.com in web browser)

- By acquiring information like information of raw-material, price, photograph of items etc. from this website, products are ordered by making use of a form available on the website or by e-mail.

- There after customer has to give more details like. His/her credit card number, card association, expiry date of card and additional information if required.

- The form has to be secured. The symbol of key is displayed in status bar of web browser which indicates the webpage in safe by encrypting.

- Authorization process is divided as shown below.

- Customer gives his credit card information to the merchant. (By filling up form on website or through E-mail)

- Merchant encrypts the payment application and provides the credit card information to the acquiring bank. These all details of customer and merchant are made secure by using Secure Socket Layer (SSL). So the details can't be misused.

- The computer system in the acquiring bank receives the above information there after all these details like Number of card holder, Name, Bank balance, credit limit given in credit card etc. are sent to card association for verification.

- Card association verifies the details. It determines whether the card holder has sufficient credit available to pay for purchases. If the customer has sufficient credit, a reference number is generated and the payment amount if blocked. This amount is known as 'open to buy' amount.

- If the credit card information is found to be insufficient, or incorrect, a message declining the transaction is transmitted to the customer through the merchant very speedily.

- After completion of all these processes, the merchant initiates the process of delivering the product to customer.

- As we discuss about authorization process shown above, it takes very less amount of time to process completes in just few hours. In contrast the settlement process may take several days or months.

- It involves transferring the money from the issuing bank of the customers to the acquiring bank of the merchant. Settlement process performs following operations.

- The merchant collects all the information of orders on periodic basis. The payment application encrypts the purchase information thereafter merchant send this information to acquiring bank.

- Here, the acquiring bank sends all this information to appropriate card association.

- After verification the amount is debited from issuing bank of customers and deposited into the merchant account. A notification of which is then sent to the merchant.

CONTINUE READING

Entities in online payment

Gateways

processors

Authorization process

Settlement process

Secure Socket Layer

Entities in online payment

Kinnari

Tech writer at NewsandStory