How does IMPS (Immediate Payment Service) Work?

Since 2010, Immediate Payment Service (IMPS) for real- time fund transfer is underway. Almost all Indian Banks allow IMPS; to put it accurately there are 53 commercial banks, 101 Rural/District/Urban and cooperative banks associated with the IMPS service. In this article you will learn what IMPS is and the functioning behind this easy fund transfer service.

How does IMPS (Immediate Payment Service) Work?

Since 2010, Immediate Payment Service (IMPS) for real- time fund transfer is underway. Almost all Indian Banks allow IMPS; to put it accurately there are 53 commercial banks, 101 Rural/District/Urban and cooperative banks signedup for the IMPS service. In this article you will learn what IMPS is and the functioning behind this easy fund transfer service.

What is IMPS?

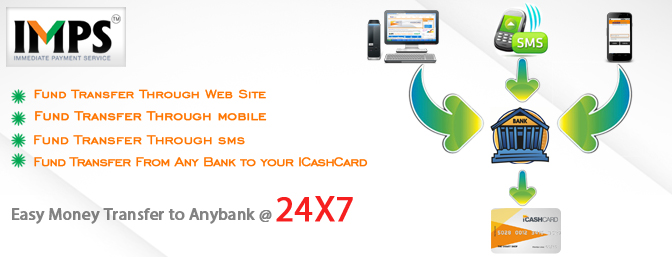

Immediate Payment Service (IMPS) is an instant real-time inter-bank electronic funds transfer system in India. IMPS offers an inter-bank electronic fund transfer service through mobile phones. It is managed by the National Payments Corporation of India (NPCI) and is built upon the existing National Financial Switch network.

In 2010, the NPCI initially carried out a venture for the mobile payment system with 4 member banks (State Bank of India, Bank of India, Union Bank of India and ICICI Bank), and expanded it to include Yes Bank, Axis Bank and HDFC Bank later that year. IMPS were publicly launched on November 22, 2010.

IMPS may also be referred to Interbank Mobile Payment Service (IMPS) and has become a part in India as almost all major banks have extended the service that enables account holders to access accounts and transfer funds using mobile phones. The service is available 24/7 throughout the year including bank holidays.

Before IMPS, Indian Banks used to use NEFT (National Electronic Funds Transfer), using this one could have transferred amount up to Rs. 2, 00,000/- and this was operated in hourly batches which means the amount first of all was debited from your bank account and then it was transferred to Reserve Bank of India and then those guys would have transferred the amount to beneficiary's account using Bank Account Details provided to them with IFSC Code, it has some timings as well and was not available on weekend and bank holidays.

How does IMPS work?

Customer to Customer Transactions- For Customer to customer to transfer, bank account holders need to register with their respective banks first. The bank then issue issues a unique seven digit number called mobile money identifier (MMID) and Mobile Banking Personal Identification Number (MPIN) to the customer. To facilitate mobile payments, customers need to feed receiver?s mobile number, MMID, the amount to be remitted and MPIN. After the transaction, both parties get SMS confirmation. At present, consumers can transact up to Rs 50,000 through IMPS every day.

Customer to Merchant Transactions and vice versa- For merchant payment, there are two types of transactions- customer initiated transaction (P2M or PUSH) and merchant initiated transactions (M2P or Pull). In customer initiated transaction or PUSH, customer initiates transaction through the Bank?s mobile banking application or SMS facility provided by the Bank. Customer needs to feed parameters such as merchant mobile number, merchant MMID, amount to be remitted, M-PIN and payment reference. Payment Reference is an optional 50 character field provided to enter the unique reference for the payment, and identifies the transaction to the merchant.

In merchant initiated transaction, the transaction is initiated through merchant application such as Merchant website, WAP site, IVR or mobile application. Merchants need to feed credentials such as service for which payment is to be made, customers mobile number, customer MMID and one-time Password (OTP). Customer needs to enter credentials like customer mobile number (as registered with the Bank), MMID (as generated by Bank) and OTP (One-Time Password generated by customer). OTP needs to be generated by customer for each transaction and is only valid for an hour from time of generation. If OTP is generated through SMS, the transaction limit is Rs 5,000 and if OTP is generated through mobile banking application, the transaction limit is as decided by the Bank (Rs 50,000 for most banks)