Incidence of Lump sum Taxes

Here, we understand about incidence of lump sum taxes in detailed with figure.

Do you have similar website/ Product?

Show in this page just for only

$2 (for a month)

0/60

0/180

Incidence of Lump sum Taxes

As we know that there are many applications of monopoly model. The essence of monopoly model is that the monopolist exercises control over the price of the commodity.

Now, we will discuss about the incidence of lump sum taxes in detail -

Incidence of Lump sum Taxes -

A lump sum tax such as a licence fee is fixed irrespective of the level of output. It means, a lump sum tax is like an increase in fixed cost which does not effect marginal cost. Hence, it does not effect the equilibrium level of output and price. It indicates that a lump sum tax cannot be shifted to the buyers. Here, the whole burden of a lump sum tax falls on the monopolist. This profit will be reduced by the amount of lump sum tax. We understand clearly with the help of diagram as mentioned below -

Figure -

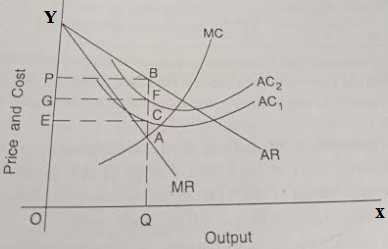

As shown in above figure, here AR and MR are average revenue curve and marginal revenue curve of the monopolist. AC1 is the average cost before the imposition of lump sum tax.

Monopolist is in equilibrium by producing output that is OQ and charging price OP, because marginal cost and marginal revenue are equal at point A. It clearly shows that Monopolist is earning profit equal to PBCE as shown in above figure.

Suppose if a lump sum tax is imposed. It will not affect marginal cost curve, but average cost curve will shift up from AC1 to AC2. Here, the gap between AC1 and AC2 indicates lump sum tax per unit of output. This gap becomes narrower as output increased because of fixed amount of lump sum tax spreads over a larger number of units of output expanded yielding successively lower lump sum tax per unit of output.

When a lump sum tax is imposed, equilibrium level of output (OQ) and price (OP) remain same, but monopolist's profit decreases from PBCE to PBFG. It clearly indicates that lump sum tax can be used to reduce income inequality of the society.

CONTINUE READING

Incidence of Lump sum Taxes

A licence fee is fixed irrespective of the level of output

Marginal cost

Output

Average cost

Monopolist

Applications of Monopoly - Incidence of Lump sum Taxes.

Kinnari

Tech writer at NewsandStory